In corporate finance management, one of the key tasks is the organization and control of payments. A corporate payment calendar is an effective tool that helps organize all the company’s financial obligations, control account balances and repay debts on time.

Importance of a corporate payment calendar

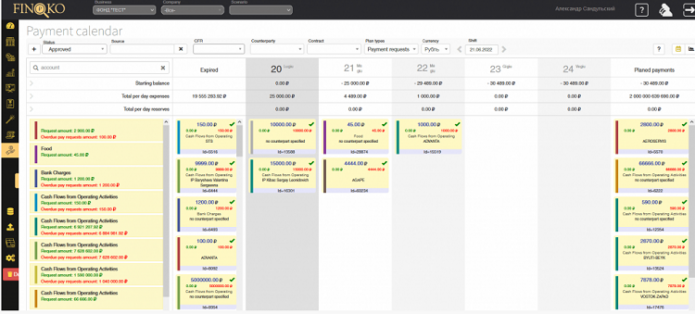

A corporate payment calendar, including a Bill Calendar, is a systematic schedule that allows you to track all upcoming payments and their deadlines. This is an important tool for financial planning, as it helps:

- avoid cash gaps;

- optimize the distribution of funds;

- manage liquidity, etc.

Having a clear payment schedule allows the company to avoid situations when there are not enough funds in the account to meet obligations. Planning helps prevent unforeseen financial difficulties and penalties for late payments. A payment calendar helps to rationally distribute incoming funds to ensure timely payment of all obligations, minimizing the need for short-term loans or credits. Planning and control over financial flows contribute to the effective management of the company’s liquidity, which is especially important during periods of instability or economic changes. How to avoid cash gaps?

Cash gaps occur when a company does not have enough funds in its account to meet all its obligations on time. It is necessary to constantly update information about upcoming payments and receipts. Using a corporate payment calendar will help you always be aware of all financial transactions and plan them in advance. You should also use the calendar to analyze and forecast future income and expenses. This will allow you to know in advance when and what amounts will need to be paid and prepare for these payments. You should also prioritize different types of payments. For example, taxes and employee salaries should be paid first, and less urgent payments can be postponed if necessary. Maintain a reserve fund to cover unexpected expenses and cash gaps. Having such a reserve will help you cope with unexpected situations without having to urgently look for additional funds.